I Tax Declaration Form

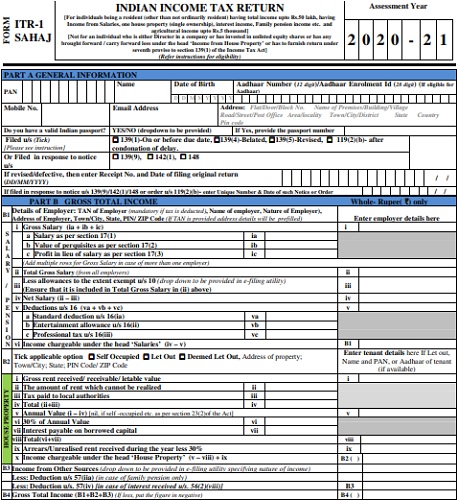

If your employee falls under any of these categories scenarios you do not need to file the form ir21 but you must submit the employee s employment income to iras via the form ir8a or auto inclusion scheme ais by 1 st mar of the following year.

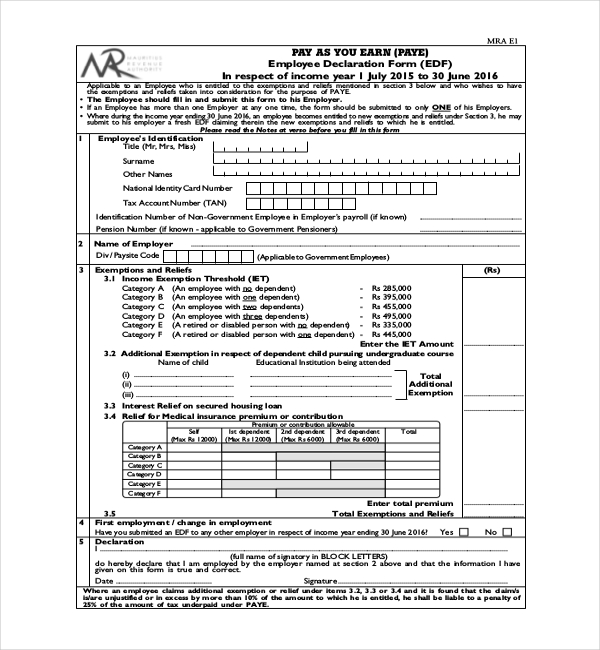

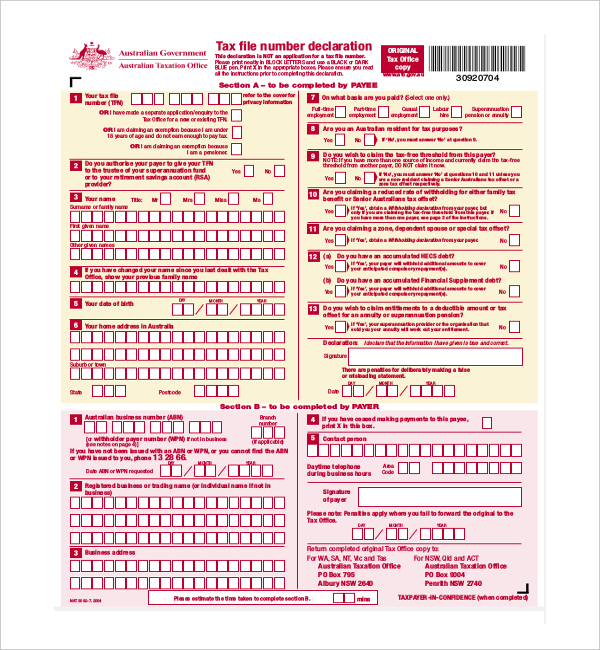

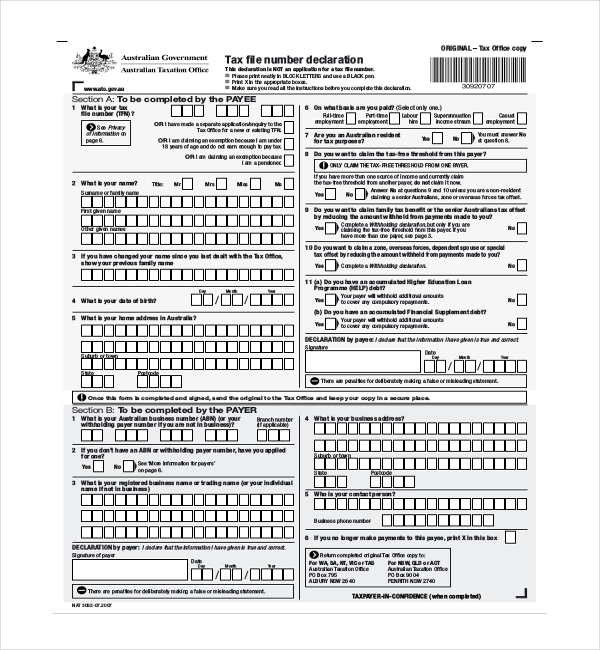

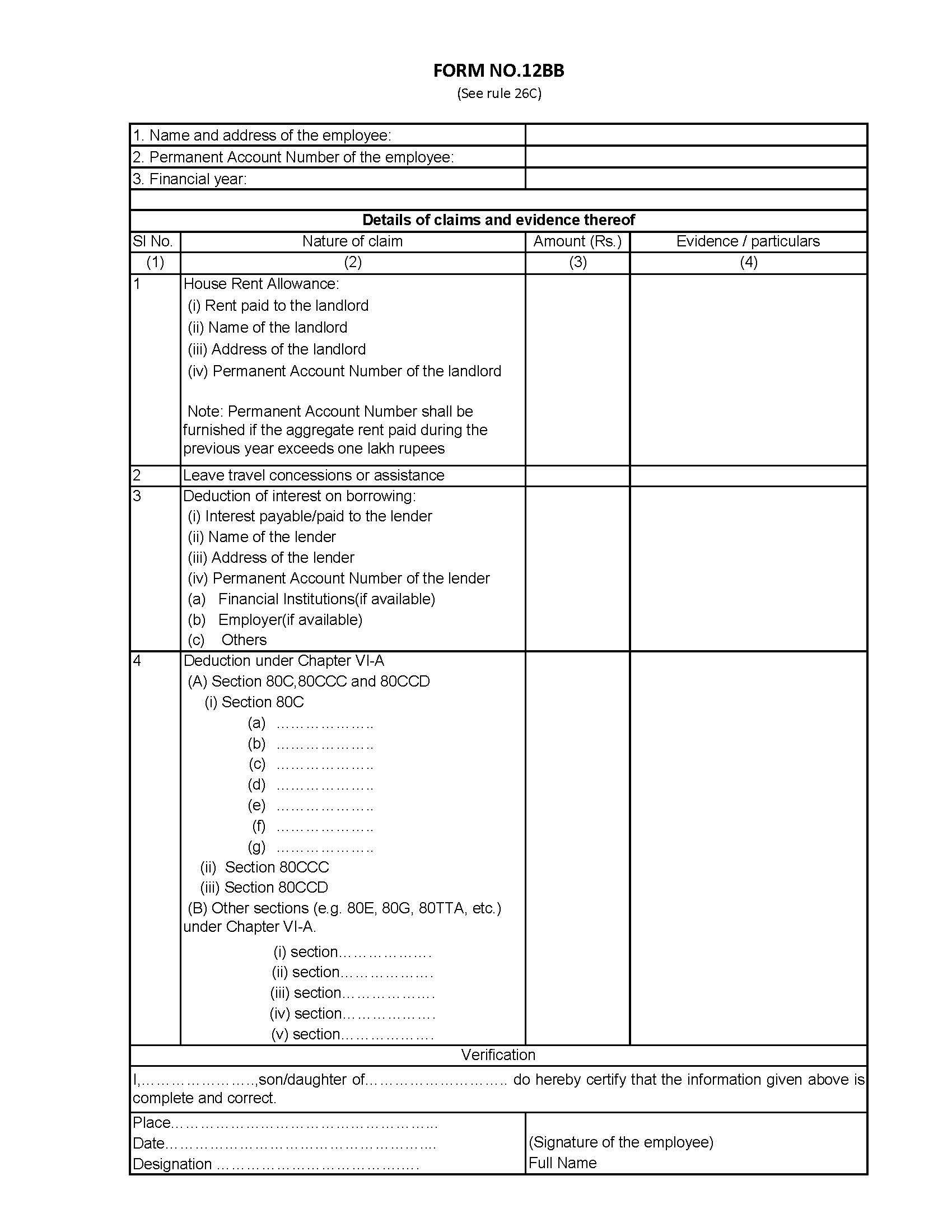

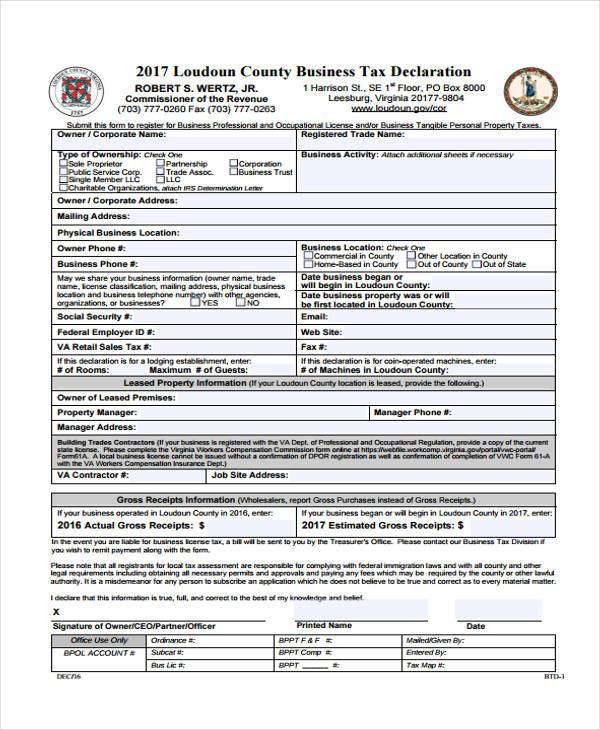

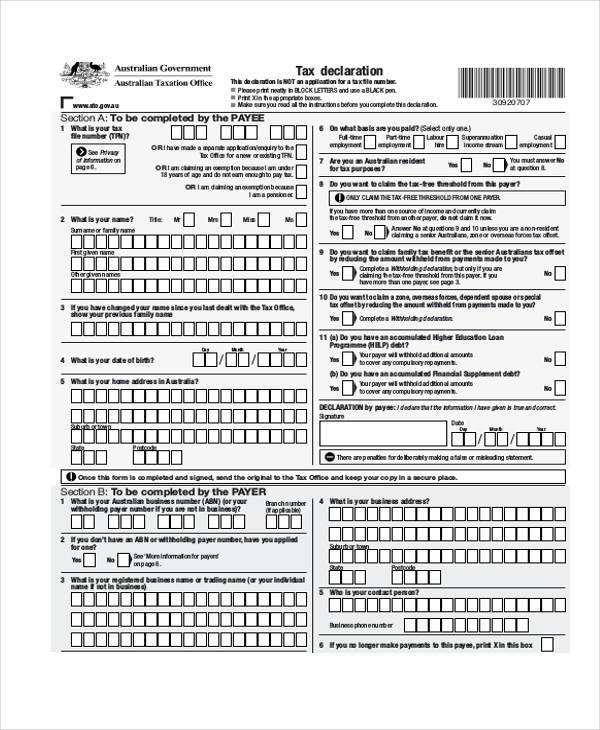

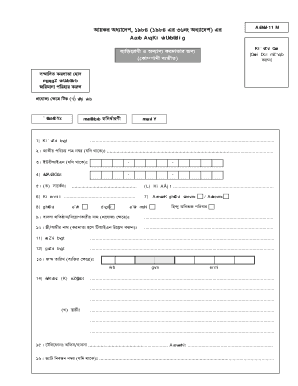

I tax declaration form. Government issued document may include any documents issued by the local law for the purposes of identi cation and may vary for different jurisdictions. 1 93 2 00 0 32 w version dated 21112017 tax residency declaration all information is required unless stated. Work out how much tax to withhold from payments made to you. Tax file number.

Information you provide in this declaration will allow your payer to. Tax code declaration ir330. Use a separate form for each employer and use only one tax code on this form. Do not use this form if you re a contractor receiving schedular payments use the tax rate notification for contractors ir330c instead.

Tax file number declaration nat 3092 07 2007 once this form is completed and signed send the original to the tax office and keep your copy in a secure place. 3 what is your registered business name or trading name or your individual name if not in business. Complete an electronic tfn declaration form if your payer currently lodges their tfn declaration reports electronically speak with your payer for more details get a paper copy of the tax file number declaration nat 3092 including both the instructions and form by either ordering online or phoning 1300 720 092 24 hours a day 7 days a week. This is not a tfn application form.

Tax clearance is not required for the following categories of employees scenarios.