W 9 Form 2020

Participating foreign financial institution to report all united states 515 withholding of tax on nonresident aliens and foreign entities.

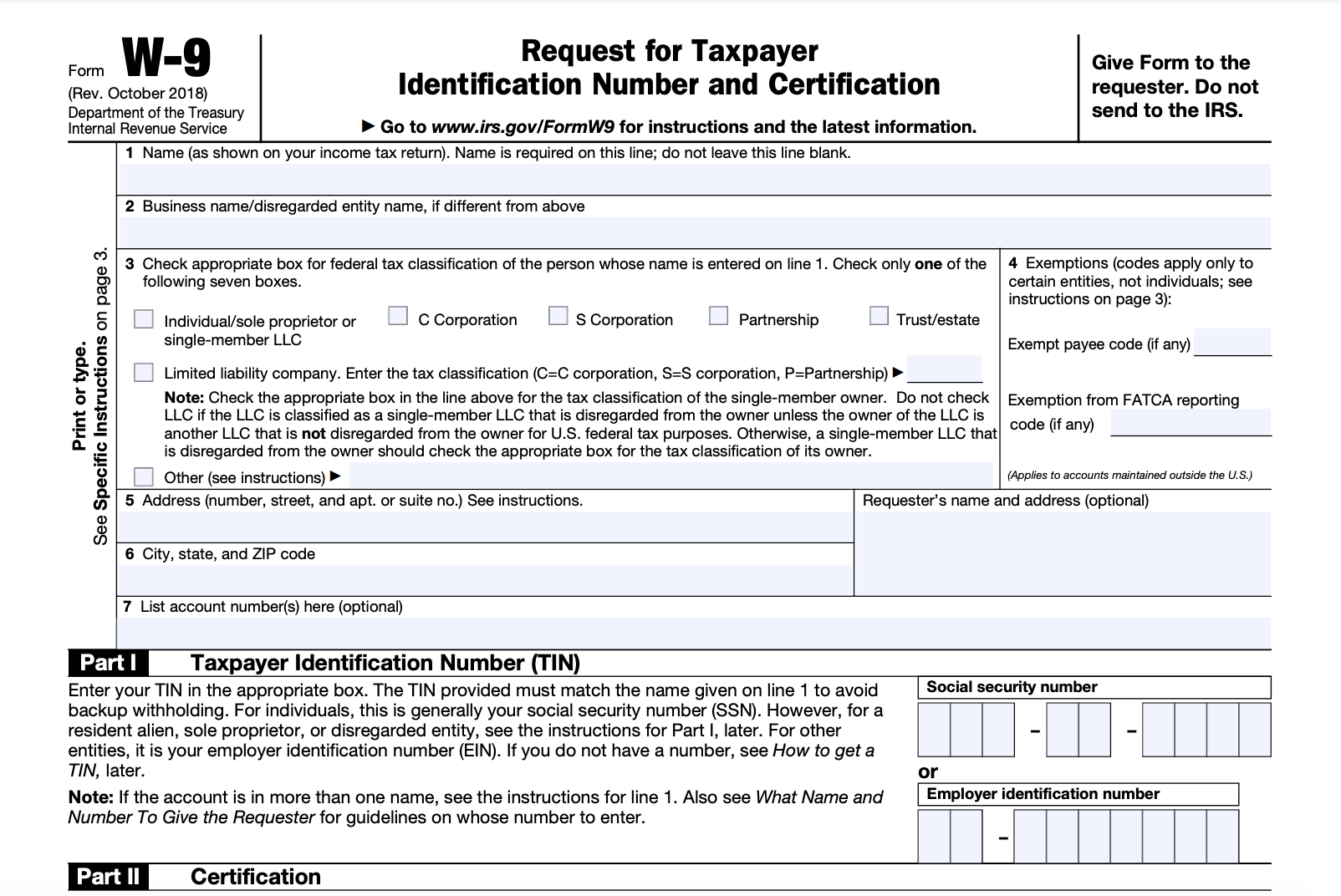

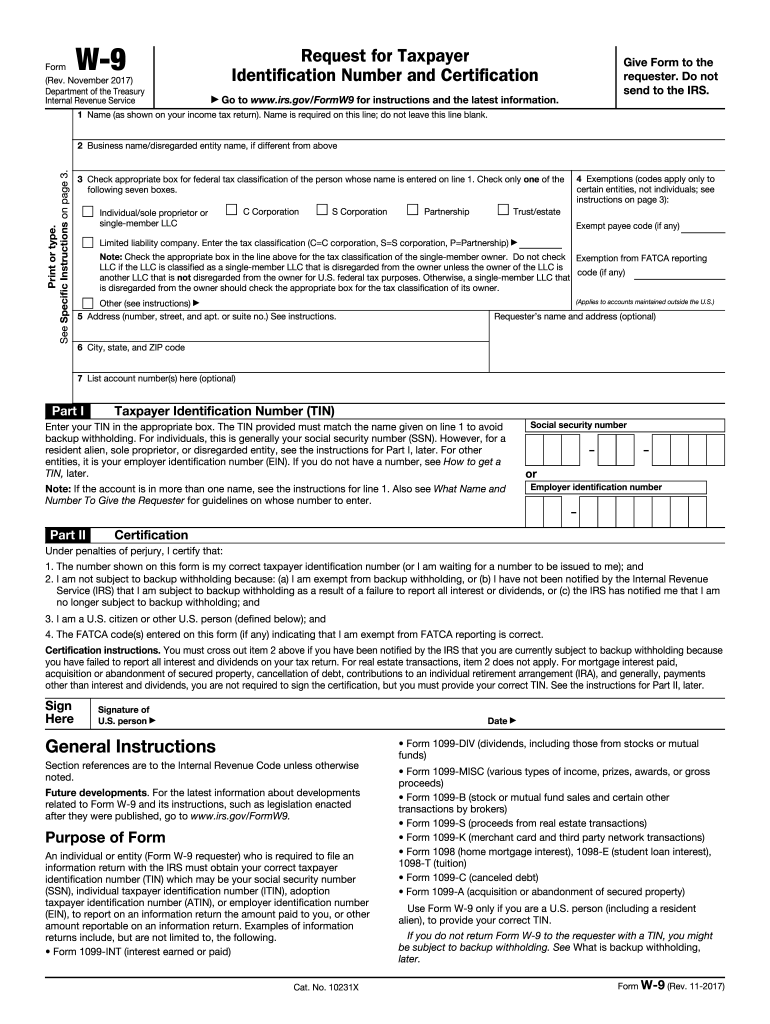

W 9 form 2020. Nonresident alien who becomes a resident alien. It doesn t ask any information about your earnings. Information about form w 9 request for taxpayer identification number tin and certification including recent updates related forms and instructions on how to file. Fill out download examples to follow.

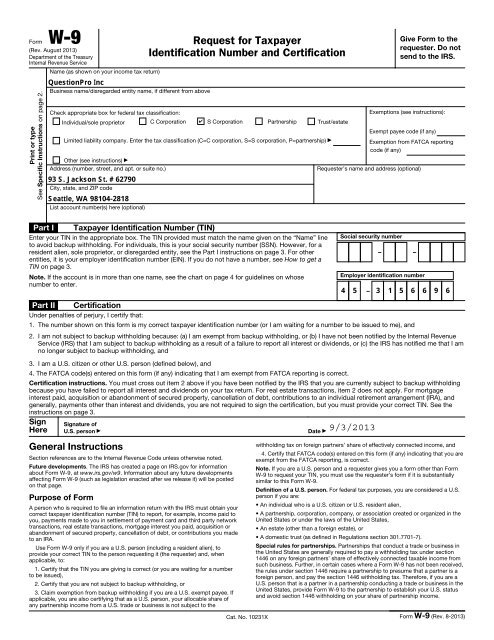

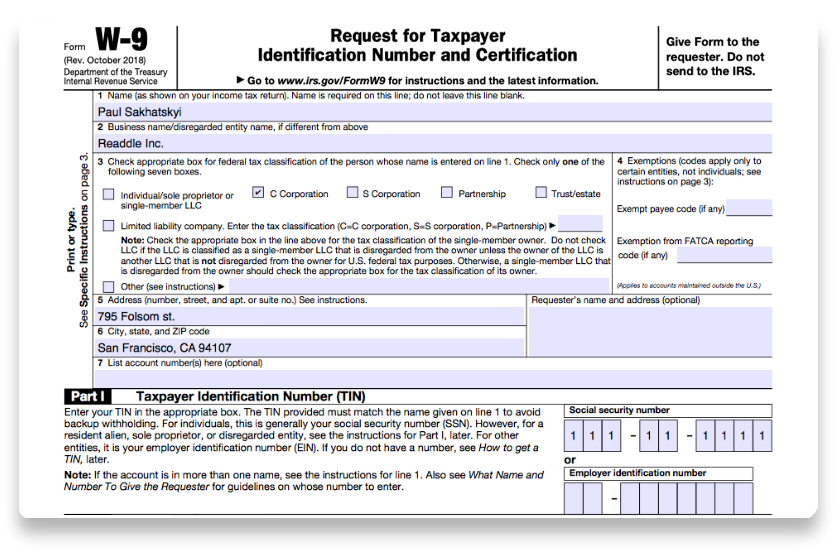

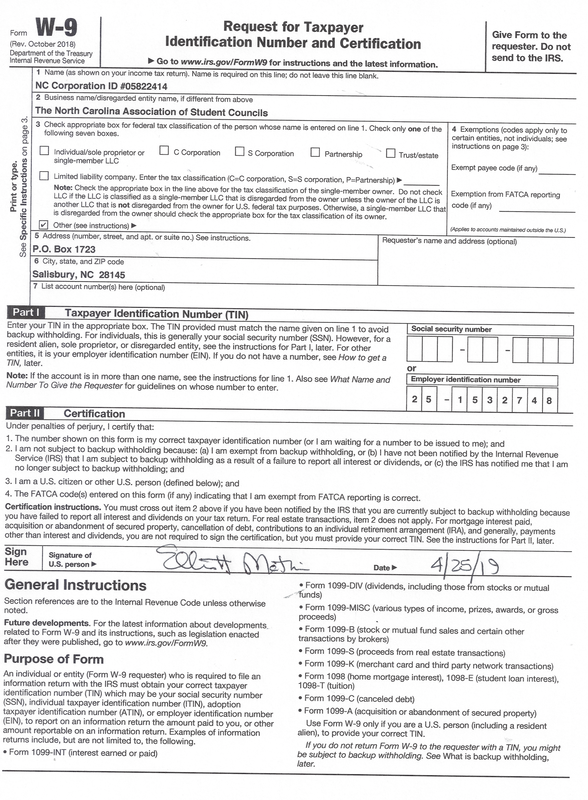

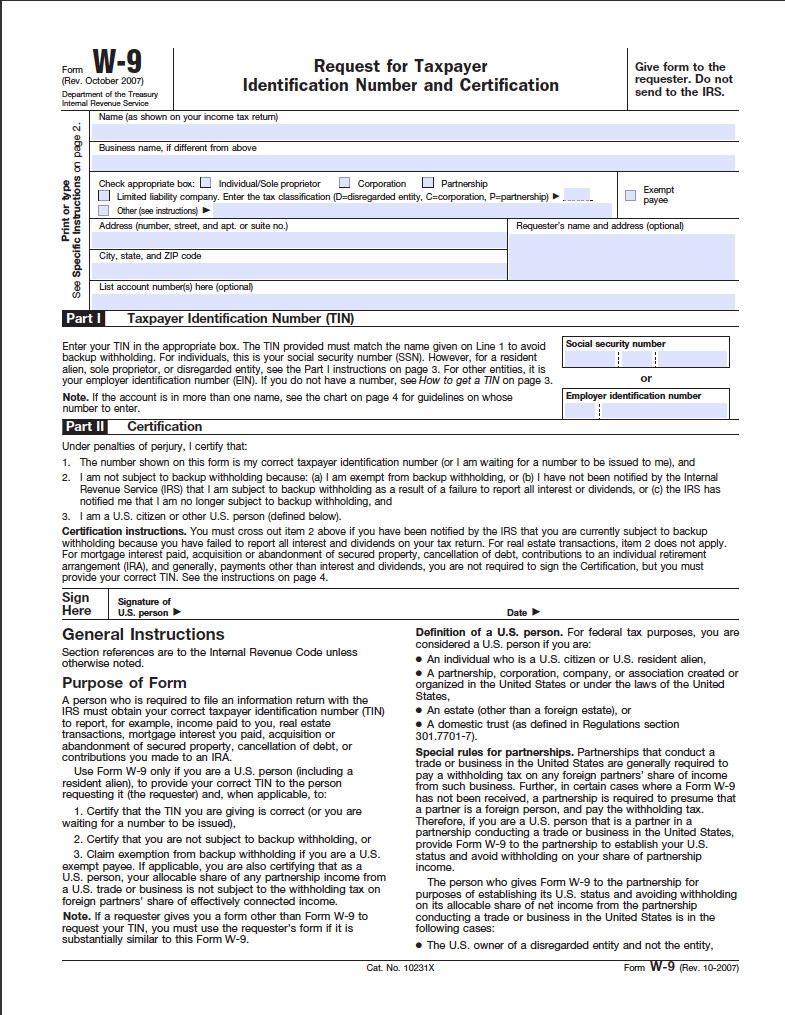

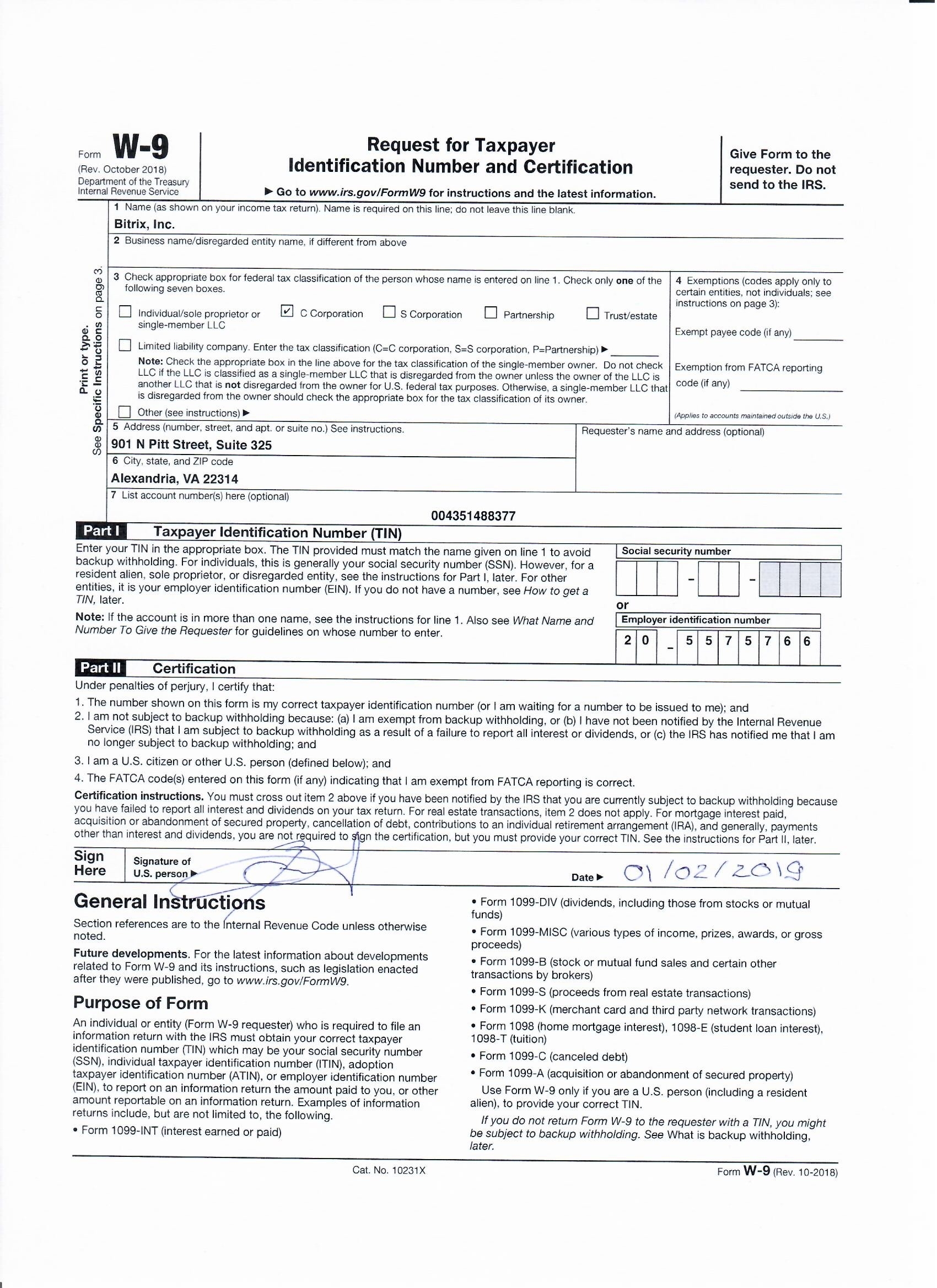

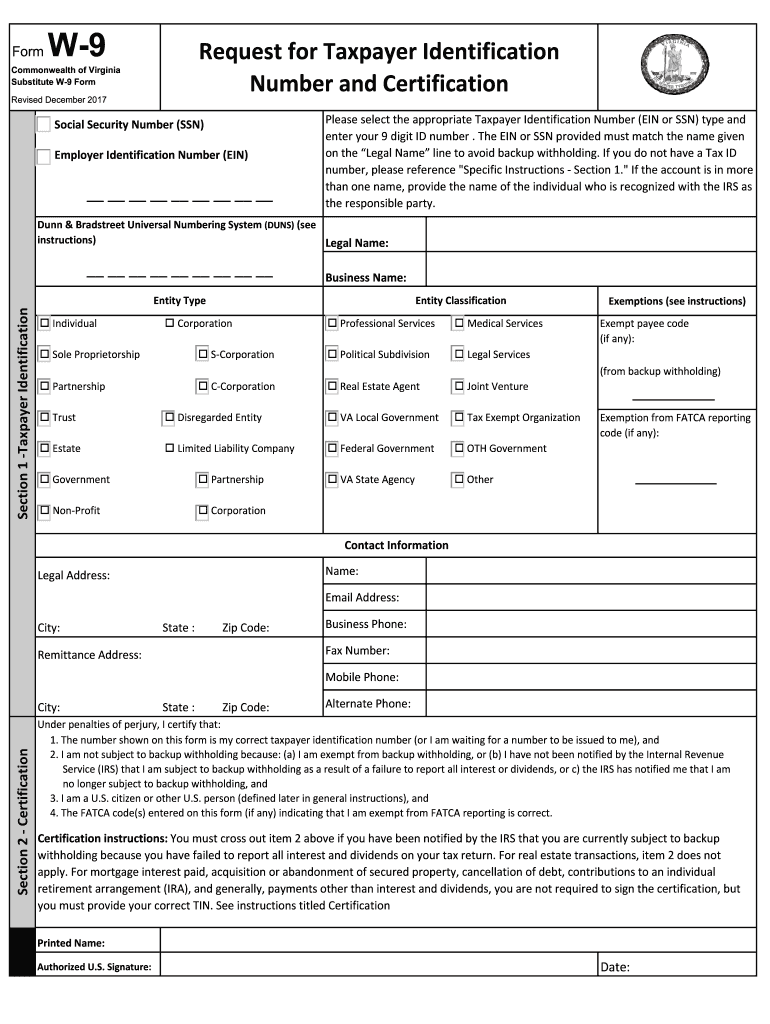

Form w 9 is used to provide a correct tin to payers or brokers required to file information returns with irs. Free printable w 9 form for 2020 if you re just starting to work as a freelancer or independent contractor you must complete a w 9 form when the payor requests it from it. W 9 is an official document that was developed by irs to control the taxation of self employed us citizens. Application for enrollment to practice before the internal revenue service 1119 11 01 2019 publ 51.

Updated w 9 form 2020. W 9 form 2020 site navigation instructions. Blank w 9 form 2020 printable. Instructions for the requestor of form w 9 request for taxpayer identification number and certification 1018 10 29 2018 form w 9 sp solicitud y certificacion del numero de identificacion del contribuyente 1018 11 07 2018 inst w 9 sp.

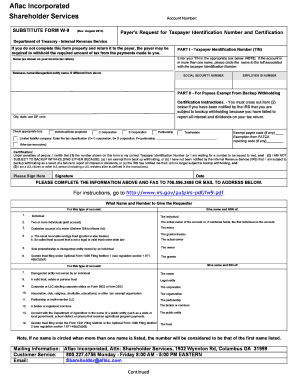

Form w 9 officially the request for taxpayer identification number and certification is used in the united states income tax system by a third party who must file an information return with the internal revenue service irs. Circular a agricultural employer s tax guide. Instead use the appropriate form w 8 or form 8233 see pub. The internal revenue service or any other agency of the federal government is responsible for providing you the documents and forms that you need to fulfill your duties.

Employers need this data to report on their annual tax returns. It requests the name address and taxpayer identification information of a taxpayer in the form of a social security number or employer identification number. Neither an employer nor freelancer should send it to the internal revenue service. Generally only a nonresident alien individual may use the terms of a tax treaty to reduce.

Form w 9 is very crucial since individuals and companies who hire freelancers to do a job for them are required to show it on form 1099 and to do so they need the information on form w 9. When collaborating with independent contractors in the us the businesses use the w 9 form to request freelancer s information.

/w-9-form-4f788e54c74c4242a4e88dc1183361f5.jpg)

/w-9-form-4f788e54c74c4242a4e88dc1183361f5.jpg)